Deduction of tax from emoluments and pensions 107 A. 27 12 422 4035 Due to time constraints it will not be possible to respond individually to comments received.

2021 Salary Guide Pay Forecasts For Marketing Advertising And Pr Positions Salary Guide Positivity Advertising

1 4 1965 Income tax Act 1961.

. The advance ruling pronounced by the Authority or the Appellate Authority under this Chapter shall be binding only a on the applicant who had sought it in respect of any matter referred to in sub-section 2 of section 97 for advance ruling. B the Pakistan tax payable in respect of the income. B Exceptions Subsection a shall not apply to 1.

Interest On State And Local Bonds IRC. Section 103A formerly read. Section 103 2 is an anti-avoidance provision which essentially allows the Commissioner of the South African Revenue Service the Commissioner to disallow the setting off of an assessed loss or balance of an assessed loss against the companys income if certain requirements are met.

2 Act 2019 is as follows-. 103 Meaning of sideways relief capital gains relief and firm 1 For the purposes of this Chapter sideways relief is a trade loss relief against general income see. Refusal of customs clearance in certain cases 106.

Whether Corporation like Tribe shall be treated as a State for purposes of section 103 with respect to bond issues for which the conditions of sections 103 and 7871 c are satisfied. Section 103 2 is an anti-avoidance provision which essentially allows the Commissioner of the South African Revenue Service the Commissioner to disallow the setting off of an assessed loss or. B on the concerned officer or the jurisdictional officer in respect of the applicant.

Lodging an objection or appeal against an assessment or decision. Services for foreign nationals. This responds to a request for rulings that 1 Authority qualifies as a political subdivision for purposes of 103 of the Internal Revenue Code the Code and 2 authority is not a related party to either City or District under 1150-1 b of the.

550 published in the Gazette on 11 July 2014 new rules werepromulgated under section 103 of the Tax Administration Act No. 28 of 2011 prescribing the procedures to be followed in lodging an objection and appeal against an assessment or a decision subject to objection and appeal referred. Section 103 omitted by the Finance Act 1965 wef.

In this regard section 103 2 provides that. Deduction of tax from. Taxable income 2 The taxable income of a taxpayer for a taxation year is the taxpayers income for the year plus the additions and minus the deductions permitted by Division C.

1 Except as provided in subsection 2 tax payable under an assessment for a year of assessment shall be due and payable on the due date whether or not that person appeals against the assessment. PART VII - COLLECTION AND RECOVERY OF TAX Section. Download or read online Tax Avoidance and Section 103 of the Income Tax Act 1962 written by South African Revenue Service.

103 b Exceptions Subsection a shall not apply to IRC. Payment of tax by companies deleted by Act A1151. 392019Central Tax Central Government appoints the 1st day of September 2019 as the date on which the provisions of section 103 of the Finance No.

In this regard section 103 2 provides that. Available in PDF ePub and Kindle. 1 Where a resident taxpayer derives foreign source income chargeable to tax under this Ordinance in respect of which the taxpayer has paid foreign income tax the taxpayer shall be allowed a tax credit of an amount equal to the lesser of.

Tax Avoidance and Section 103 of the Income Tax Act 1962 Revised Proposals You are invited to send your comments regarding these revised proposals on or before 13 October 2006 to. Section 103 applies only to schemes in which the taxpayer entered into a transaction solely or mainly for the purpose of obtaining a tax benefit. 103 b 1 Private Activity Bond Which Is Not A Qualified Bond.

Private Letter Rulings - IRC Section 103. 28 of 2011 the TAAprescribing the rules related to. This is a subjective test in other words the court is required to look into the taxpayer s mind as best it can and determine whether he had such a sole or main purpose.

Code 103 - Interest on State and local bonds US. Legal and Policy Division published by Unknown which was released on 2006. In terms of Government Notice No.

Act Nepal provides in depth comprehensive content with many tools summaries a forum for acts rules regulations in Nepal. Income Tax Act Part. 2 1 An income tax shall be paid as required by this Act on the taxable income for each taxation year of every person resident in Canada at any time in the year.

Section 103 2 is an anti-avoidance provision which essentially allows the Commissioner of the South African Revenue Service the Commissioner to disallow the setting off of an assessed loss or balance of an assessed loss against the companys income if certain requirements are met. Rules promulgated under section 103 of the tax administration act 2011 act no. Recovery by suit 107.

Income tax act means the income tax act 1962 act no. Disbursement of refund by single authority. 103 a Exclusion Except as provided in subsection b gross income does not include interest on any State or local bond.

2 Act 2019 shall come into force. Recovery from persons leaving Malaysia 105. Deleted by Act A1151 History Section 103A deleted by Act A1151 of 2002 s16 with effect from year of assessment 2004.

Tax Avoidance and Section 103 of the Income Tax Act 1962. Extract of section 103 of the Finance No. Code Notes prev next a Exclusion Except as provided in subsection b gross income does not include interest on any State or local bond.

Get Tax Avoidance and Section 103 of the Income Tax Act 1962 Books now. FY 2076-77 Fines and Penalties under Income Tax Act FY 2076-77 Income Tax Rates FY 2076-77 Tax Deduction at Source TDS Rates FY 2075-76 Income Tax Rates FY 2075-76 Procedures. Permits licences and rights.

Payment of tax 103 A. PART VII - COLLECTION AND RECOVERY OF TAX Chapter.

Pin By Khareem Brucedayne Sudlow On Online Business Marketing Online Business Marketing Taxact Tax Forms

Pin By Zmejias On Order Click Rent Apt One Thousand Five Hundred Apt Pictou

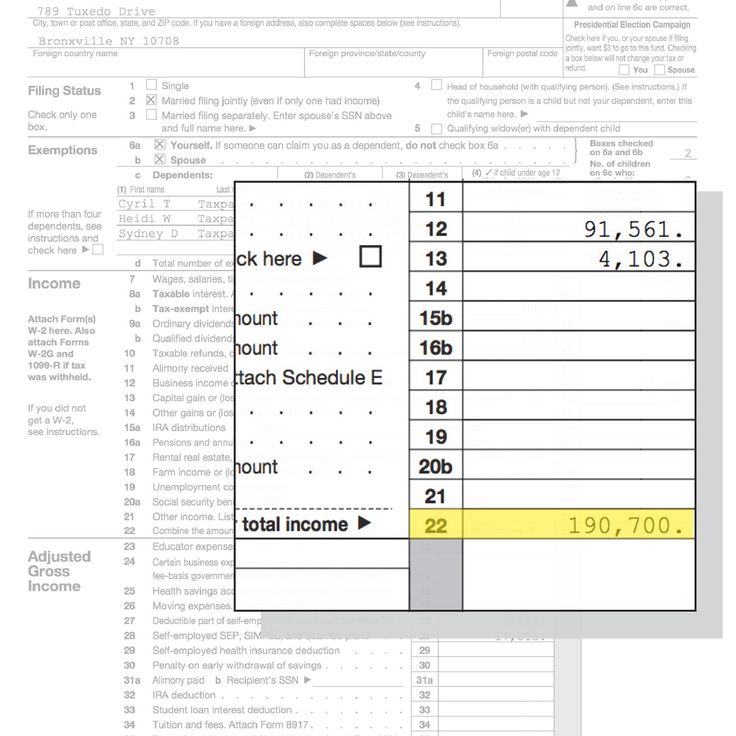

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Tax Forms

What I Learned From Looking At 200 Machine Learning Tools Machine Learning Tools Learning Tools Machine Learning

If Deduction Towards Expenses Is Not Denied Then The Liability Related To Such Expenses Can Not Be Treated As Unexplained Liability Deduction Income Tax Taxact

Tips For Business Record Keeping Paycheck Simple Math Paying

Outsourcing Vs Offshoring Which Works Best On Ground Outsourcing Business Strategy Mobile App

Pin By The Taxtalk On Income Tax Deposit Accounting Cash

Tax Forms For Filing Taxes 2016 Taxes Filing Taxes Tax Forms Tax

Earthquake Waves Seismic Wave Biology Facts Earthquake Waves

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Tax Forms

Indian Taxation Full Education Vcds Set Education Income Tax Post

03 Salary Survey Report 2014 In Myanmar Infographic Crossroads Magazine Vol1 Iss4

Tax Spreadsheets For Photographers Etsy Budget Spreadsheet Spreadsheet Spreadsheet Template

U S Master Tax Guide Hardbound Edition 2020 Wolters Kluwer Tax Guide Pdf Books Free Pdf Books

The Laws Of Thermodynamics A Very Short Introduction In 2022 Thermodynamics Oxford University Press Arrow Of Time

Taxupdate Taxlaw Tax Taxsaving Taxseason Taxrefund Taxreturn Incometaxseason Incometax Incometaxreturn Chart Income Tax Return Income Tax Tax Refund